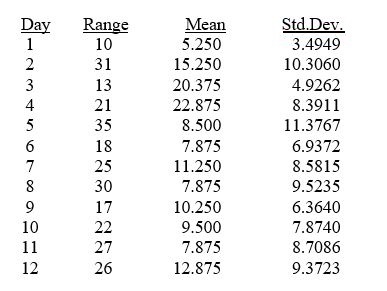

TABLE 17-8

Recently, a university switched to a new type of computer-based registration. The registrar is concerned with the amount of time students are spending on the computer registering under the new system. She decides to randomly select 8 students on each of the 12 days of the registration and determine the time each spends on the computer registering. The range, mean, and standard deviation of the times required to register are in the table that follows.

-Referring to Table 17-8, an R chart is to be constructed for the time required to register. One way to create the upper control limit involves multiplying the mean of the sample ranges by D₄. For this data set, the value of D₄ is ________.

Definitions:

Ultraviolet Radiation

Electromagnetic radiation with a wavelength shorter than that of visible light but longer than X-rays, capable of causing sunburn and other types of damage.

Skin Cancers

Malignancies that arise from the skin, often due to overexposure to UV radiation, including melanoma, basal cell carcinoma, and squamous cell carcinoma.

Eye Cataracts

A medical condition where the lens of the eye becomes progressively opaque, leading to blurred vision and, if untreated, blindness.

Human Immune System

The complex network of cells, tissues, and organs that work together to defend the body against infections, diseases, and foreign substances.

Q5: An airline wants to select a computer

Q8: Referring to Table 16-13, what is the

Q14: Many organizations mistakenly spend more time and

Q17: Referring to Table 15-4, what is the

Q45: Referring to Table 16-6, the estimate of

Q85: Referring to Table 14-17 Model 1, _

Q153: The minimum expected opportunity loss is also

Q221: The use of the finite population correction

Q233: Referring to Table 14-18, what is the

Q272: Referring to Table 8-1, there are 10