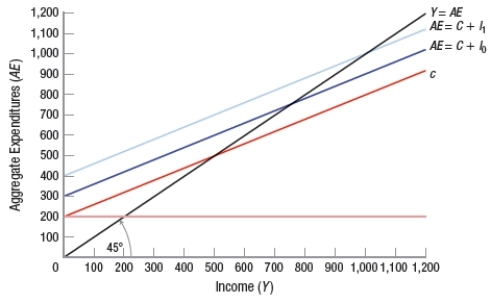

(Figure: Simple Keynesian Model) In the figure, suppose investment has increased from AE = C + I0 to AE = C + I1. The multiplier equals

Definitions:

Stock Put Option

A financial derivative that gives the holder the right, but not the obligation, to sell a specified quantity of a stock at a set price within a certain time period.

Expiration Time

The specific date and time when an options or futures contract becomes void and the rights to exercise it cease.

Call Contract

An options contract that gives the holder the right to buy an underlying asset at a specified price within a certain period.

Write

In finance, this term often refers to the act of selling a derivative contract, such as an option, thus obligating the writer to fulfill the contract terms if exercised.

Q15: If income rises from $3,000 per month

Q46: If the interest rate increases, investment will<br>A)

Q58: An increase in net export spending will

Q102: The actual price level is determined by<br>A)

Q109: The long-run aggregate supply curve is horizontal.

Q112: According to the wealth effect, as prices

Q118: Aggregate expenditures are equal to consumption plus

Q145: A(n) _ in government spending, a _

Q276: Suppose the market basket of goods costs

Q282: Governments that run budget deficits benefit from