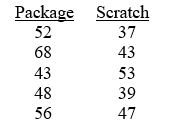

TABLE 12-1

A perfume manufacturer is trying to choose between 2 magazine advertising layouts. An expensive layout would include a small package of the perfume. A cheaper layout would include a "scratch-and-sniff" sample of the product. The manufacturer would use the more expensive layout only if there is evidence that it would lead to a higher approval rate. The manufacturer presents both layouts to 5 groups and determines the approval rating from each group on both layouts. The data are given below. Use this to test whether the median difference in approval rating is different from zero in favor of the more expensive layout with a level of significance of 0.05.

-Referring to Table 12-1, what is the rank of the absolute difference for the last pair of observations?

Definitions:

Treynor Measure

A performance metric that measures the returns earned in excess of that which could have been earned on a riskless investment per each unit of market risk.

Standard Deviation

A measure of the dispersion or variability in a set of values, used to assess the risk associated with a particular security or investment portfolio.

Beta

A measure of a stock's volatility in relation to the overall market; a beta above 1 indicates the stock is more volatile than the market, while a beta below 1 indicates the stock is less volatile.

Nonlinear Factor Exposures

Nonlinear Factor Exposures refer to investment sensitivities to market factors that do not change in a straight-line (linear) relationship with the market's movements.

Q44: Generally, external opportunities and threats are<br>A) uncontrollable

Q81: When using the exponentially weighted moving average

Q98: The need to amortize massive R&D investments

Q104: Referring to Table 16-13, what is the

Q108: A buyer for a manufacturing plant suspects

Q109: Referring to Table 9-1, if you select

Q110: Business ethics, _, and sustainability issues are

Q119: Referring to Table 17-3, suppose the analyst

Q266: Referring to Table 8-1, we do not

Q300: Referring to Table 12-2, the decision made