(Table) Based on the table

Definitions:

Payroll Tax Deductions

Amounts withheld from an employee's wages by an employer for taxes, including federal and state income tax and FICA taxes.

FUTA Tax Credit

A credit against Federal Unemployment Tax Act (FUTA) tax liability that employers can claim for amounts paid into state unemployment funds.

Life Insurance

A contract providing payment to designated beneficiaries upon the insured person’s death, offering financial protection against the loss of income.

Health Insurance

A type of insurance coverage that pays for medical and surgical expenses incurred by the insured or reimburses them for expenses from illnesses or injuries.

Q6: Investment in human capital refers to<br>A) education,

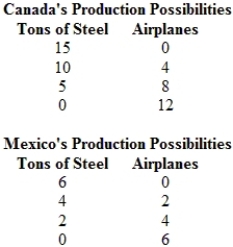

Q85: (Table) Using the data in the table

Q215: A shift in the demand curve can

Q218: Which event will cause an increase in

Q223: Which is considered a land resource?<br>A) a

Q253: How is the equilibrium price determined? What

Q262: Which graph concerning electric vehicles indicates an

Q296: Sales of luxury consumer products for cats

Q298: A laissez-faire approach to the question "How

Q332: Which event would shift the supply curve