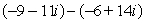

Simplify:

Definitions:

CAPM

Capital Asset Pricing Model, a framework used to determine the theoretical expected return of an asset or portfolio, taking into account its risk relative to the overall market.

Expected Return

The anticipated profit or loss from an investment, taking into account the probability of varying outcomes.

Pure Time Value

The portion of an option's price that reflects the potential for value change based on the time remaining until its expiration.

Market Risk Premium

The bonus yield an investor projects to receive by placing their money in a risky market portfolio instead of in assets that carry no risk.

Q4: Unique Creations holds a monopoly position in

Q4: What additional considerations might lead LP to

Q6: Do you agree that criminals can be

Q11: Would yogurt or Prada handbags have wider

Q16: Solve for y: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Solve for

Q38: For the polynomial function <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="For

Q51: Factor the following expression: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Factor

Q52: Solve: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Solve: A)

Q70: Solve for y: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Solve for

Q78: Multiply: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Multiply: A)