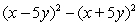

Simplify by expanding:

Definitions:

Marginal Tax Rates

The rate at which the last dollar of income is taxed, reflecting the percentage of tax applied to your next dollar of taxable income.

Interest Income

Revenue earned from investments in interest-bearing financial instruments, such as bonds, savings accounts, or loans.

Eligible Dividends

Dividends that are qualified for special tax treatment under certain jurisdictions.

Tax Paid

The amount of money paid to the government as a result of taxable activities, such as income earned or goods sold.

Q2: Is there anything unusual about the divison

Q5: Simplify: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Simplify: A)

Q10: An industry produces its product, Scruffs, at

Q34: Find the equation of the line that

Q35: Simplify: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Simplify: A)

Q57: Graph: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Graph: A)

Q64: Factor: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Factor: A)

Q85: Solve. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Solve. A)

Q93: Two cyclists start from the same point

Q131: Solve the following compound inequality. Write the