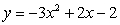

Use the discriminant to determine the number of x-intercepts of the graph:

Definitions:

Contact Information

Details such as phone number, email address, or physical address that enable communication with an individual or organization.

Privacy Officer

A designated individual responsible for ensuring that an organization complies with privacy laws and regulations, managing privacy policies, and safeguarding personal information.

Protected Health Information

Any information about health status, provision of health care, or payment for health care that can be linked to an individual.

Access

The ability or right to obtain or make use of healthcare services, often emphasizing the ease and availability of healthcare.

Q4: Find the number of decibels of sound.

Q5: The enzyme produced by the salivary glands

Q36: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="If evaluate

Q37: Solve by taking square roots: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg"

Q63: Simplify by expanding: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Simplify by

Q73: Graph by using the slope and y-intercept:

Q103: The daily low temperatures during one week

Q116: Simplify: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Simplify: A)

Q118: Solve. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Solve. A)

Q132: Write 0.45 as a percent.<br>A) 4.5 %<br>B)