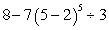

Evaluate the following expression using the Order of Operations Agreement.

Definitions:

Therapy

A treatment aimed at relieving emotional distress and mental health problems, typically involving verbal communication with a healthcare professional.

Implosive Techniques

Therapeutic techniques intended to help individuals confront feared situations or thoughts in a controlled manner to reduce anxiety.

Classical Conditioning

A learning process that occurs when two stimuli are repeatedly paired: a response that is at first elicited by the second stimulus is eventually elicited by the first stimulus alone.

Operant Conditioning

A process of learning in which behavior that leads to satisfying consequences is likely to be repeated.

Q7: In the ECG pattern, how do segments

Q11: When a female is standing in anatomical

Q13: Which of the male reproductive organs produce(s)

Q22: Find the minimum or maximum of the

Q22: The lens on a telescope has

Q25: Solve <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Solve .

Q29: An herbalist has 20 oz of herbs

Q29: Solve the following inequality: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg" alt="Solve

Q54: Solve by taking square roots: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg"

Q62: Solve by taking square roots: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8311/.jpg"