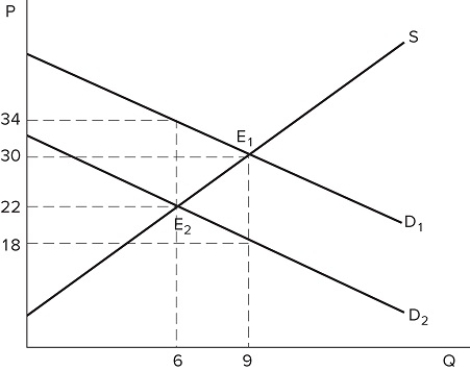

The graph shown demonstrates a tax on buyers. What is the amount of deadweight loss generated by this tax?

The graph shown demonstrates a tax on buyers. What is the amount of deadweight loss generated by this tax?

Definitions:

Head Injury

A trauma to the head that can lead to various degrees of brain damage, ranging from mild concussions to severe brain injury.

Unconscious

A state where a person is not awake and not aware of their surroundings or able to react to stimuli.

Tremor

An involuntary, rhythmic muscle contraction leading to shaking movements in one or more parts of the body, often affecting the hands, arms, eyes, face, head, vocal cords, trunk, and legs.

Alcohol

A chemical compound commonly found in beverages such as beer, wine, and spirits, characterized by its intoxicating effect when consumed.

Q2: The table shown displays the price-level adjustments

Q4: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8194/.jpg" alt=" Assume the market

Q8: The table shown displays CPI data for

Q22: Suppose Sam's opportunity cost of producing a

Q39: The CPI attempts to:<br>A) balance out the

Q48: In a well-functioning competitive market, total surplus:<br>A)

Q66: When we say the cost of living

Q91: GDP counts:<br>A) only final goods and services.<br>B)

Q105: If a market is missing:<br>A) deadweight loss

Q125: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8194/.jpg" alt=" The graph shown