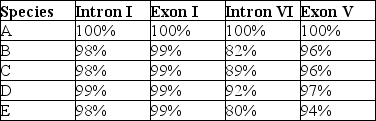

The next questions refer to the following table, which compares the % sequence homology of four different parts (two introns and two exons) of a gene that is found in five different eukaryotic species. Each part is numbered to indicate its distance from the promoter (e.g., Intron I is the one closest to the promoter) . The data reported for species A were obtained by comparing DNA from one member of species A to another member of species A.

% Sequence Homology

-Based on the tabular data, and assuming that time advances vertically, which cladogram (a type of phylogenetic tree) is the most likely depiction of the evolutionary relationships among these five species?

Definitions:

Lump-Sum Tax Rate

A tax that is a fixed amount, no matter the change in circumstance of the taxed entity. This creates a situation where the tax burden falls more heavily on those with lower income or profit.

Marginal Tax Rate

The amount of tax applied to an additional dollar of income, often used in progressive tax systems.

Average Tax Rate

The ratio of the total amount of taxes paid to the total tax base (taxable income or spending), expressing the percentage of income that is paid in taxes.

Income

Monetary payment received for work, from investments, or from government benefits, contributing to an individual's wealth.

Q2: Evidence of which structure or characteristic would

Q5: A multigene family is composed of<br>A) multiple

Q13: In order for speciation to occur, what

Q24: What is bioinformatics?<br>A) a technique using 3-D

Q30: A bacterium is infected with an experimentally

Q34: The most important feature that permits a

Q35: You are given an unknown organism to

Q40: Which of these paired fungal structures are

Q48: Rocky Mountain juniper (Juniperus scopulorum)and one-seeded juniper

Q69: Which of the following involves metabolic cooperation