The next few questions refer to the following description and Table 28.1.

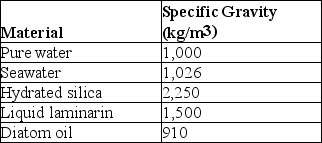

Diatoms are encased in Petri-platelike cases (valves) made of translucent hydrated silica whose thickness can be varied. The material used to store excess calories can also be varied. At certain times, diatoms store excess calories in the form of the liquid polysaccharide, laminarin, and at other times as oil. The following are data concerning the density (specific gravity) of various components of diatoms, and of their environment.

Table 28.1 Specific Gravities of Materials Relevant to Diatoms

-Judging from Table 28.1 and given that water's density and, consequently, its buoyancy decrease at warmer temperatures, in which environment should diatoms (and other suspended particles) sink most slowly?

Definitions:

Federal Taxes

Federal Taxes are imposed by the government on income, goods, services, and activities, used to fund public services and government operations.

Schedule A

A form used in the United States tax system for itemizing allowable deductions against personal income to reduce taxable income.

Tax Rate Schedule

A chart or table that determines the amount of tax due based on income brackets, applicable to different filing statuses.

Total Income

The aggregate amount of income earned by an individual or entity from all sources before any deductions or taxes.

Q4: Which of the following are structures of

Q19: Which of the following statements provides the

Q26: Jaws first occurred in which extant group

Q35: In a Hardy-Weinberg population with two alleles,

Q43: Prokaryotes' essential genetic information is located in

Q44: Which species is probably an important contributor

Q55: A trend first observed in the evolution

Q56: Which of these, if discovered among cycliophorans,

Q77: Many mammals have skins and mucous membranes

Q78: If nudibranch rhinophores are located at the