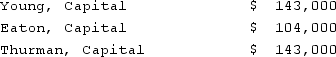

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net loss for the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net loss for the first year?

Definitions:

Statute of Frauds

A rule of law mandating that some agreements must be documented in written form to be legally binding.

Signature of Guarantor

The act of signing by a guarantor, who agrees to fulfill the obligations of a debtor in case the debtor fails to meet their commitments.

Written Agreement

A formal, documented contract between parties, outlining terms and conditions that are legally binding.

Written Contract

A legally binding agreement between two or more parties that is documented and signed in writing.

Q3: Which 21st-century film could best be described

Q5: Name the auteur who made his career

Q32: Name the film that focuses on the

Q34: Coyote Corp. (a U.S. company in Texas)had

Q38: Assume the partnership of Dean, Hardin, and

Q53: Withdrawals from the partnership capital accounts are

Q73: Ginvold Co. began operating a subsidiary in

Q82: Which of the following is not a

Q91: Potter Corp. (a U.S. company in Colorado)had

Q96: Johnson, Inc. owns control over Kaspar, Inc.