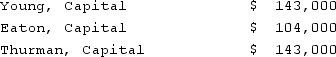

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net loss for the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net loss for the first year?

Definitions:

Ownership

The legal right or state of having control over something, such as property or a business.

Commercial Paper

An unsecured, short-term debt instrument issued by corporations, typically for the financing of accounts receivable and inventories.

Short-Term Financing

Funding obtained for a period of one year or less, used to cover immediate needs such as working capital requirements.

Q2: According to current research, which are associated

Q4: Shortly after founding the American Mutoscope and

Q6: This former comedy partner of Fatty Arbuckle

Q21: This film-which first paired John Ford and

Q29: MASH utilizes which conflict as a backdrop

Q38: Ryan Company purchased 80% of Chase Company

Q43: Name the auteur who reinvented the Hollywood

Q62: Assume the partnership of Howell, Madrid, and

Q81: Which of the following is not a

Q89: On January 1, 2021, Lamb and Mona