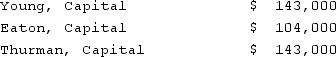

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Eaton's Capital account at the end of the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Eaton's Capital account at the end of the first year?

Definitions:

Gambling

The wagering of money or something of value on an event with an uncertain outcome, often with the primary intent of winning additional money or material goods.

Alcohol Use

The consumption of beverages containing ethanol, which can vary from infrequent drinking to the frequent and intense consumption that characterizes abuse.

Physical Well-Being

The health and fitness of the body, including factors such as nutrition, exercise, and absence of disease.

Subjective Well-Being

An individual's self-evaluated happiness or satisfaction with life, incorporating emotional reactions and cognitive judgments.

Q10: You are an executive at HBO.Write a

Q16: This release strategy best matches the needs

Q37: Jell and Dell were partners with capital

Q42: Name the inventor of the photograph.<br>A) George

Q55: The following information has been taken from

Q57: Jipsom and Klark were partners with capital

Q62: Under what circumstances would the remeasurement of

Q73: When a company has preferred stock in

Q74: Coyote Corp. (a U.S. company in Texas)had

Q91: Stark Company, a 90% owned subsidiary of