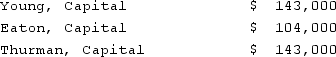

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Young's total share of net income for the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Young's total share of net income for the second year?

Definitions:

Q14: Parker Corp., a U.S. company, had the

Q19: Goodman, Pinkman, and White formed a partnership

Q38: Name the studio whose style was synonymous

Q40: Stars provide studios with which of the

Q45: This 1967 film starring Warren Beatty and

Q49: P, L, and O are partners with

Q58: Certain balance sheet accounts of a foreign

Q70: Akers Co. owned 8,000 shares (80%)of the

Q88: What happens when a U.S. company purchases

Q104: Pot Co. holds 90% of the common