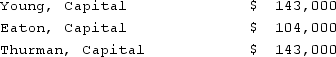

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net income for the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Eaton's total share of net income for the second year?

Definitions:

Hypotheses Testing

Hypotheses testing is a statistical method used to make decisions about the properties of a population based on sample data, involving the testing of an assumption or hypothesis.

Restaurant Types

Categories or classifications of restaurants based on factors such as cuisine, service style, and pricing.

Friedman Test

An approach in statistics, free from parametric constraints, used to detect treatment variances across a series of test efforts.

7-point Scale

A scale, often used in surveys and questionnaires, that provides seven levels for respondents to express their agreement, satisfaction, or intensity of feeling about a statement or question.

Q6: This former comedy partner of Fatty Arbuckle

Q7: Gone with the Wind deals with which

Q15: Which Howard Hawks film features Marilyn Monroe

Q19: Goodman, Pinkman, and White formed a partnership

Q22: Name the pornographic film that had wide

Q36: Which of the following are hallmarks of

Q41: During World War II, which export market

Q50: Which 21st-century movie star best matches the

Q74: Parent Corporation acquired some of its subsidiary's

Q79: On May 1, 2021, Mosby Company received