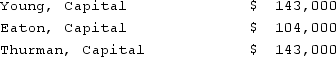

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net income for the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net income for the second year?

Definitions:

Direct Labor Hours

The total hours worked by employees directly involved in the manufacturing process or providing services.

Budgeted Costs

Predicted or planned expenses that are outlined in a company's budget for a specific period.

Fabricating Department

The division within a manufacturing company where raw materials are assembled or processed into finished goods.

Assembling Department

A section within a manufacturing facility where components are put together to form a final product.

Q1: Domestic home video accounts for approximately what

Q2: Spielberg and Lucas eventually gained independence from

Q8: Spike Lee extensively uses this device in

Q9: Anderson Company, a 90% owned subsidiary of

Q16: Name the filmmaker who refined crosscutting in

Q24: Hitchcock's thematic preoccupations include which one of

Q42: Will Co. owned 80% of the voting

Q100: When using the current rate method, the

Q100: Stark Company, a 90% owned subsidiary of

Q113: Which of the following statements are true