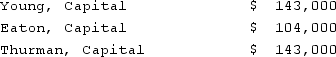

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Young's Capital account at the end of the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Young's Capital account at the end of the second year?

Definitions:

Projective Personality

A type of personality assessment that relies on projecting one's own interpretations onto ambiguous stimuli to uncover underlying thoughts and feelings.

Objective Personality

Personality assessment tools or methods that rely on structured, standardized questions or prompts to evaluate personality traits with minimal subjective interpretation.

Bender Visual-Motor Gestalt Test

A psychological assessment tool that evaluates visual-motor functioning, planning, and organizational abilities through the copying of geometric shapes.

Projective Personality

Assessment techniques that use ambiguous stimuli to elicit responses reflecting aspects of an individual's personality.

Q2: An adult patient reports frequent episodes of

Q8: On January 1, 2021, Lamb and Mona

Q9: Name the Charlie Chaplin sound film that

Q9: Which 21st-century movie star best matches James

Q37: Name the auteur who began his career

Q41: During World War II, which export market

Q57: On October 1, 2021, Eagle Company forecasts

Q62: Assume the partnership of Howell, Madrid, and

Q87: On April 1, 2020, Shannon Company, a

Q94: Quadros Inc., a Portuguese firm was acquired