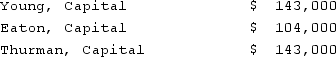

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Eaton's Capital account at the end of the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Eaton's Capital account at the end of the second year?

Definitions:

Environmentally Sound

Practices or operations that have a minimal negative impact on the environment, promoting sustainability.

Lease Rate

The cost of leasing or renting a particular asset, property, or equipment, usually expressed as a payment amount per time period.

Sale And Leaseback

A transaction where a company sells an asset and leases it back from the buyer, providing liquidity while retaining the asset's use.

Lessee

A lessee is a person or entity who rents land or property from a lessor under the terms of a lease agreement.

Q2: All of the following were preconditions for

Q3: A child with a history of asthma

Q29: Which of the following statements is true

Q30: This industry term translates a star's popularity,

Q38: According to the Center for the Study

Q41: Which Hollywood film exhibits the same sustained

Q84: Marshall Co. was formed on January 1,

Q99: Quadros Inc., a Portuguese firm was acquired

Q116: Malone Co. owned 70% of Bernard Corp.'s

Q118: The balance sheets of Butler, Inc. and