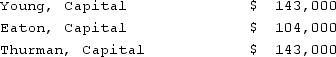

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Young's Capital account at the end of the first year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was the balance in Young's Capital account at the end of the first year?

Definitions:

Office Salaries Payable

This term refers to the obligation or amounts due to office employees for wages earned but not yet disbursed by the company.

Accumulated Depreciation

The total amount of depreciation expense that has been recorded for an asset since its acquisition.

Worksheet

A worksheet is a document or a digital spreadsheet used for organizing, calculating, and analyzing data, especially for tasks involving financial information or planning.

Q15: Describe Hollywood's relationship to television in the

Q23: Before the advent of sound technology, which

Q28: Which studio gave Francis Ford Coppola's production

Q28: Name the actress who ultimately successfully challenged

Q31: Under the temporal method, common stock would

Q35: On January 1, 2021, Parent Corporation acquired

Q37: Jell and Dell were partners with capital

Q47: A partnership began its first year of

Q85: Quadros Inc., a Portuguese firm was acquired

Q91: Potter Corp. (a U.S. company in Colorado)had