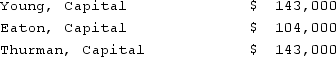

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net income for the second year?

The Articles of Partnership stipulated that profits and losses be assigned in the following manner:Young was to be awarded an annual salary of $26,000 and $13,000 salary was to be awarded to Thurman.Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.Each partner withdrew $13,000 per year.Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.What was Thurman's total share of net income for the second year?

Definitions:

Corporations

Legal entities that are separate and distinct from their owners, capable of owning property, entering into contracts, and being sued.

Law Professors

Educators and scholars in the field of law who teach and conduct research at law schools, contributing to the education of future lawyers and the development of legal theory.

Low-Paid Secretaries

Secretarial staff who receive wages at the lower end of the pay scale, often reflecting issues of undercompensation and undervaluation.

Attorneys

Licensed professionals authorized to practice law and represent clients in legal matters.

Q2: Frankfurter Company, a U.S. company, had a

Q11: Woolsey Corporation, a U.S. company, expects to

Q15: What condition(s)qualify an entity as a VIE?

Q24: How can a parent corporation determine the

Q40: What do you believe the themes of

Q41: This Sofia Coppola film stars Scarlett Johansson

Q42: On December 1, 2021, King Co. sold

Q42: This film noir features extensive lighting and

Q47: What is a company's functional currency?<br>A)The currency

Q47: How do outstanding subsidiary stock warrants affect