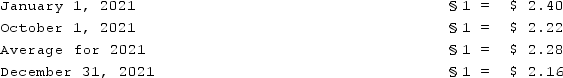

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Definitions:

Defined Contribution Plan

A retirement plan in which the employer, employee, or both make contributions on a regular basis, and the final benefits received depend on the investment's performance.

Defined Benefit Plan

A retirement plan where the employer guarantees a specified pension payment upon retirement, based on the employee's earnings history, tenure of service, and age.

Retirement Benefit Program

A financial support plan provided by employers or governments to employees after they retire from active work.

Dental Coverage

A type of health insurance that covers a portion of the costs associated with dental care, including routine checkups, cleanings, x-rays, and certain procedures.

Q4: What is meant by the spot rate?

Q5: In 2018, this movie-ticket subscription service shook

Q9: This sci-fi franchise follows the plight of

Q11: This term refers to the business practice

Q14: Name the provocateur, actor, writer, and director

Q21: Why was Hollywood reluctant to convert to

Q45: This 1967 film starring Warren Beatty and

Q58: Where do intra-entity transfers of inventory appear

Q65: Under the current rate method, inventory at

Q75: Peter, Roberts, and Dana have the following