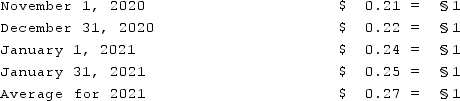

A subsidiary of Dunder Inc., a U.S. company, was located in a foreign country. The functional currency of this subsidiary was the Stickle (§) which is the local currency where the subsidiary is located. The subsidiary acquired inventory on credit on November 1, 2020, for §160,000 that was sold on January 17, 2021 for §207,000. The subsidiary paid for the inventory on January 31, 2021. Currency exchange rates between the dollar and the Stickle were as follows:  What amount would have been reported for cost of goods sold on Dunder's consolidated income statement at December 31, 2021?

What amount would have been reported for cost of goods sold on Dunder's consolidated income statement at December 31, 2021?

Definitions:

Budgeted Selling Price

The price at which a company plans to sell its products or services, often used in budgeting and financial forecasting.

Direct Labor-Hours

A quantification of the total hours spent by employees working directly on the production of goods or services.

Total Cash Collected

The sum of all cash received by a company during a specified period, including sales, accounts receivable collections, and other cash receipts.

Collections

The process of recovering the amounts owed to a business by its debtors or the action of receiving payments.

Q5: On December 1, 2021, Keenan Company, a

Q12: Name the German expressionist filmmaker who immigrated

Q24: Name the star who was often typecast

Q26: Which of the following were reasons Paramount

Q39: The forward rate may be defined as<br>A)The

Q39: The 1960s musical revival was defined by

Q46: Popper Co. acquired 80% of the common

Q92: Quadros Inc., a Portuguese firm was acquired

Q99: On January 1, 2021, A. Hamilton, Inc.

Q120: McGuire Company acquired 90 percent of Hogan