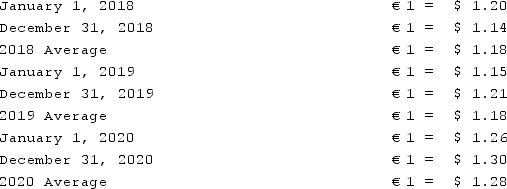

A subsidiary of Reynolds Inc., a U.S. company, was located in a foreign country. The local currency of this subsidiary was the Euro (€) while the functional currency of this subsidiary was the U.S. dollar. The subsidiary acquired Equipment A on January 1, 2018, for €250,000. Depreciation expense associated with Equipment A was €25,000 per year. On January 1, 2020, the subsidiary acquired Equipment B for €150,000 and Equipment B had associated depreciation expense of €10,000. The subsidiary owned no other depreciable assets. Currency exchange rates between the U.S. dollar and the Euro were as follows:  What amount would have been reported for total equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018?

What amount would have been reported for total equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2018?

Definitions:

English Auctions

A method of sale in which the price ascends and participants bid openly against each other, with the item being sold to the highest bidder.

Sealed-bid Auctions

Auctions in which all bidders simultaneously submit their bids in sealed envelopes, with no bidder knowing the bid of the others.

Common-value Auction

An auction format where the item for sale has the same value for everyone, but bidders have different information about that value.

Oral Auctions

Public sales where goods or services are sold to the highest bidder through verbal bids.

Q24: On January 1, 2019, Jannison Inc. acquired

Q37: Which 21st-century movie star best matches the

Q40: A foreign subsidiary uses the first-in first-out

Q41: Thomas Inc. had the following stockholders' equity

Q42: Tim Burton solidified his unique aesthetic with

Q43: Name the film noir that features a

Q43: Name the screenwriter and director who signed

Q62: Assume the partnership of Howell, Madrid, and

Q79: Regency Corp. recently acquired $500,000 of the

Q94: Quadros Inc., a Portuguese firm was acquired