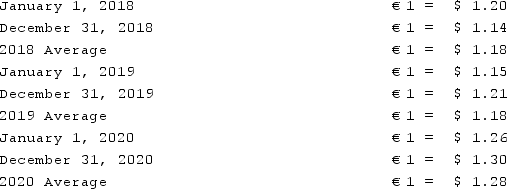

A subsidiary of Reynolds Inc., a U.S. company, was located in a foreign country. The local currency of this subsidiary was the Euro (€) while the functional currency of this subsidiary was the U.S. dollar. The subsidiary acquired Equipment A on January 1, 2018, for €250,000. Depreciation expense associated with Equipment A was €25,000 per year. On January 1, 2020, the subsidiary acquired Equipment B for €150,000 and Equipment B had associated depreciation expense of €10,000. The subsidiary owned no other depreciable assets. Currency exchange rates between the U.S. dollar and the Euro were as follows:  What amount would have been reported for total equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2020?

What amount would have been reported for total equipment owned by the subsidiary in Reynolds's consolidated balance sheet at December 31, 2020?

Definitions:

Social Media Sites

Digital platforms that enable users to create, share, or exchange information, ideas, and content in virtual communities and networks.

American Adults

Individuals over the age of 18 living in the United States, representing various demographics, cultures, and backgrounds.

Broadcast News

The dissemination of news and current events to the public via television, radio, or internet broadcasts.

Hispanic Media

Media outlets, channels, and platforms that are specifically designed to cater to the Hispanic community, offering content relevant to their cultural and linguistic preferences.

Q5: Pell Company acquires 80% of Demers Company

Q9: Which 21st-century movie star best matches James

Q16: Lewis Corp. acquired all of the voting

Q19: Which of the following internal record-keeping methods

Q20: While Hollywood made documentary and newsreel films

Q46: Popper Co. acquired 80% of the common

Q53: Hollywood talent were compelled to sign exclusive

Q60: Which of the following statements is false

Q74: Donald, Anne, and Todd have the following

Q110: During 2021, Parent Corporation purchased at carrying