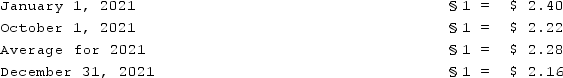

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Prepare an income statement for this subsidiary in stickles and then translate these amounts into U.S. dollars.

Definitions:

Account Numbers

Unique identifiers assigned to individual accounts in an organization's chart of accounts, facilitating accurate recording, classification, and reporting of financial transactions.

Normal Credit Balances

Accounts with a credit balance as expected in the accounting equation; for instance, liabilities, equity, and revenue accounts normally have credit balances.

Revenues

The total amount of money received by a company for goods sold or services provided during a certain period of time.

Net Income

The total profit of a company after all operating expenses, taxes, and interest are deducted from total revenue.

Q13: Why do intra-entity transfers between the component

Q15: Goodman, Pinkman, and White formed a partnership

Q37: Renz Co. acquired 80% of the voting

Q44: This subgenre typically focuses on two people

Q47: A partnership began its first year of

Q61: Nelson Co. ordered parts costing §120,000 from

Q82: Pell Company acquires 80% of Demers Company

Q88: What happens when a U.S. company purchases

Q98: Dodd Co. acquired 75% of the common

Q100: Pell Company acquires 80% of Demers Company