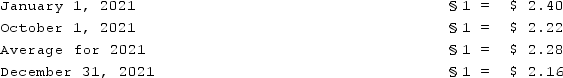

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare a statement of retained earnings for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Prepare a statement of retained earnings for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

Lottery Ticket

A piece of paper or a digital token that allows the holder a chance to win a prize in a drawing of lots.

Inter Vivos Gift

A gift given by a living person during their lifetime, as opposed to a bequest or legacy left in a will, which does not take effect until after the donor's death.

Constructively Presented

A concept where something is deemed to be presented or made available through implication or through the circumstances, rather than by direct presentation.

Donative Intent

The intention to give a gift expressed by a donor, a key requirement in the law of gifts to demonstrate that a transfer is indeed intended as a gift.

Q11: Parent Corporation had just purchased some of

Q19: The Hollywood studio system was threatened by

Q28: The conglomerate-owned studios shifted production practices toward

Q39: The forward rate may be defined as<br>A)The

Q46: Walsh Company sells inventory to its subsidiary,

Q52: On April 1, Quality Corporation, a U.S.

Q73: Pell Company acquires 80% of Demers Company

Q87: Several years ago, Polar Inc. acquired an

Q93: Walsh Company sells inventory to its subsidiary,

Q97: McGuire Company acquired 90 percent of Hogan