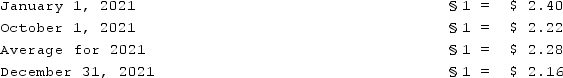

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2021 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2022. A building was then purchased for §170,000 on January 1, 2021. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2021. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:

Prepare a statement of cash flows for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Prepare a statement of cash flows for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

Times Interest Earned Ratio

A financial metric that measures a company's ability to meet its debt obligations by comparing its income before interest and taxes to its interest expenses.

Creditors' Protection

Legal and financial mechanisms in place to ensure that creditors can reclaim some value from a borrower in case of default, insolvency, or bankruptcy.

Present Value

The immediate value of a prospective sum of money or stream of cash flows, using a specific interest rate for calculation.

Equivalent

A term expressing a state of equality or equivalency in value, function, or meaning.

Q13: Which of the following characteristics is not

Q25: Wilson owned equipment with an estimated life

Q37: Name the auteur who began his career

Q38: Pell Company acquires 80% of Demers Company

Q53: A parent company owns a controlling interest

Q62: On January 1, 2021, Musical Corp. sold

Q79: Virginia Corp. owned all of the voting

Q86: What theoretical argument could be made against

Q91: Which of the following is not a

Q110: Pepe, Incorporated acquired 60% of Devin Company