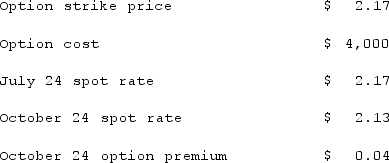

Woolsey Corporation, a U.S. company, expects to sell goods to a British customer at a price of 250,000 pounds, with delivery and payment to be made on October 24, 2021. On July 24, 2021, Woolsey purchased a three-month put option for 250,000 British pounds and designated this option as a cash flow hedge of a forecasted foreign currency transaction expected to be completed in late October, 2021. The following exchange rates apply:  What amount will Woolsey include as an option expense in net income for the period July 24 to October 24?

What amount will Woolsey include as an option expense in net income for the period July 24 to October 24?

Definitions:

Rational-Ignorance Effect

A phenomenon where individuals decide not to acquire information because the cost of doing so outweighs the expected benefits.

Voters

Individuals who are eligible to vote in elections, making decisions about who will hold public office and on various issues.

Political Choices

Decisions made by individuals, groups, or governments that relate to the governance of a country, state, or local area.

Public Choice Analysis

A branch of economics that studies the decision-making behaviors of voters, politicians, and government officials from the perspective of economic theory.

Q4: Webb Company purchased 90% of Jones Company

Q6: Under the current rate method, property, plant

Q8: Pell Company acquires 80% of Demers Company

Q30: An intra-entity transfer of a depreciable asset

Q37: Renz Co. acquired 80% of the voting

Q41: A partnership began its first year of

Q49: P, L, and O are partners with

Q85: Beatty, Inc. acquires 100% of the voting

Q104: Pot Co. holds 90% of the common

Q110: Pepe, Incorporated acquired 60% of Devin Company