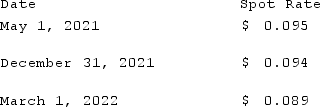

On May 1, 2021, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2022. On May 1, 2021, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2022 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2021. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

Definitions:

Composite Units

A measure used in accounting to bundle goods or services together for the purposes of inventory management, costing, or sales analysis.

Fixed Costs

Costs that remain constant regardless of a business's operational levels, like lease payments, wages, and coverage fees.

Break-Even Point

The point at which total costs and total sales are equal, resulting in no net loss or gain for the business.

Contribution Margin

The gap between income from sales and variable expenses, which is utilized to pay for fixed expenses and produce earnings.

Q12: On January 1, 2019, Glenville Co. acquired

Q17: Pot Co. holds 90% of the common

Q21: Gale Co. was formed on January 1,

Q27: The ban on on-screen nudity came to

Q35: Name the auteurs behind the Top Gun

Q38: Ryan Company purchased 80% of Chase Company

Q40: A foreign subsidiary uses the first-in first-out

Q41: Under the temporal method, property, plant &

Q101: Where is the remeasurement gain or loss

Q122: McGraw Corp. owned all of the voting