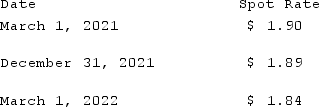

On March 1, 2021, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2022. On March 1, 2021, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2022 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2021. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net impact on Mattie's 2021 income as a result of this fair value hedge of a firm commitment?

Mattie's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the net impact on Mattie's 2021 income as a result of this fair value hedge of a firm commitment?

Definitions:

True Value

The accurate, fair, or intrinsic worth or importance of something.

Bidders

Individuals or entities that offer a price for goods, services, or assets in an auction or tender process.

Bid-rigging

A form of fraud where competitors collude to inflate prices in procurement bids, undermining fair competition.

Cartels

Associations of independent businesses or organizations that agree to regulate production, pricing, and marketing of goods to maximize profits.

Q2: What are techniques that a parent company

Q2: A partnership began its first year of

Q9: Anderson Company, a 90% owned subsidiary of

Q14: In 1989, these two communications companies merged,

Q20: Which contemporary film best captures the sentiments

Q48: Quadros Inc., a Portuguese firm was acquired

Q63: Waite, Inc. owns 85% of Knight Corp.

Q70: On January 1, 2019, Jannison Inc. acquired

Q82: Which of the following is not a

Q86: Authoritative literature provides guidance for hedges of