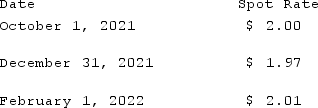

On October 1, 2021, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2022, at a price of 100,000 British pounds. On October 1, 2021, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2021, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of option expense for 2022 from these transactions?

What is the amount of option expense for 2022 from these transactions?

Definitions:

Operating Income

Earnings from a company's core business operations, excluding expenses and revenues that are unrelated to the primary activities.

Unit Selling Price

The cost for one unit of a product when it is sold.

Unit Variable Costs

Costs that vary directly with the volume of production or sales, such as materials and labor, on a per-unit basis.

Contribution Margin Ratio

A financial metric that measures the portion of revenue remaining after variable production costs that can contribute to covering fixed costs and generating profit.

Q6: This franchise has continually defined the superhero

Q7: On January 1, 2021, Kapoor Co. sold

Q19: Wolff corporation owns 70% of the outstanding

Q28: Which description best matches Quentin Tarantino's aesthetic?<br>A)

Q32: Stark Company, a 90% owned subsidiary of

Q36: Goodman, Pinkman, and White formed a partnership

Q44: Coyote Corp. (a U.S. company in Texas)had

Q91: Which of the following is not a

Q116: Malone Co. owned 70% of Bernard Corp.'s

Q119: Kaye Company acquired 100% of Fiore Company