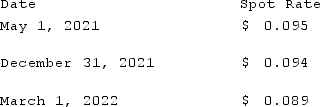

On May 1, 2021, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2022. On May 1, 2021, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2022 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2021. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the impact on Mosby's 2022 net income as a result of this fair value hedge of a firm commitment?

Mosby's incremental borrowing rate is 12%, and the present value factor for two months at a 12% annual rate is 0.9803.What was the impact on Mosby's 2022 net income as a result of this fair value hedge of a firm commitment?

Definitions:

Q7: Under the current rate method, retained earnings

Q7: Choose one director from the following list

Q9: Name the Orson Welles film that was

Q14: This form of revenue became an important

Q22: Walsh Company sells inventory to its subsidiary,

Q65: Which of the following methods is not

Q70: Under the initial value method, the parent

Q72: McGuire Company acquired 90 percent of Hogan

Q121: Which one of the following varies between

Q122: McGraw Corp. owned all of the voting