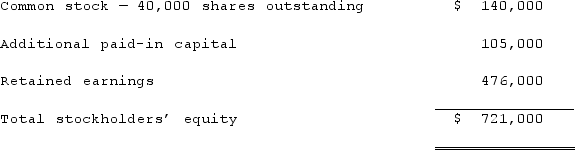

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2019, when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Traceable Fixed Expenses

Fixed costs that can be directly associated with a specific product, department, or segment of a business.

Common Fixed Expenses

Recurring expenses that do not vary with the level of production or sales, shared by multiple departments or products.

Promotional Campaign

A series of marketing efforts intended to increase awareness or sales of a product or service.

Store Segment Margin

The profit generated by a specific retail store or division after direct costs are subtracted, but before corporate overhead expenses are allocated.

Q4: What is meant by the spot rate?

Q49: P, L, and O are partners with

Q51: What is pre-acquisition income?

Q55: Certain balance sheet accounts of a foreign

Q70: Goodman, Pinkman, and White formed a partnership

Q76: For what events or conditions should the

Q82: King Corp. owns 85% of James Co.

Q87: Several years ago, Polar Inc. acquired an

Q88: What should an entity evaluate when making

Q90: Which of the following statements is true