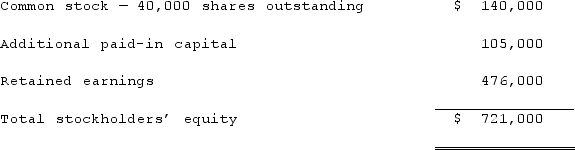

Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2019, when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share. None of these shares belonged to Popper. How would this transaction have affected the additional paid-in capital of the parent company?

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2022.Popper did not pay any premium when it acquired its original interest in Cocker. On January 1, 2022, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.On January 1, 2022, Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share. None of these shares belonged to Popper. How would this transaction have affected the additional paid-in capital of the parent company?

Definitions:

Cash Payments Journal

A journal used in accounting to record all cash outflows or payments made by a company.

Revenue Journal

A specialized accounting journal used to record the sales of services or goods on credit, highlighting the revenue aspect of transactions.

Fees Earned

Revenue generated by a company through the provision of services.

Customer Invoices

Financial documents issued by a seller to a buyer, detailing the sale transaction and requesting payment.

Q11: Woolsey Corporation, a U.S. company, expects to

Q14: On January 1, 2021, Musical Corp. sold

Q24: How can a parent corporation determine the

Q32: Danbers Co. owned 75% of the common

Q33: Norr and Caylor established a partnership on

Q46: How is the fair value allocation of

Q63: Parent sold land to its subsidiary resulting

Q67: Contrast the purpose of remeasurement with the

Q85: Skipen Corp. had the following stockholders' equity

Q118: The balance sheets of Butler, Inc. and