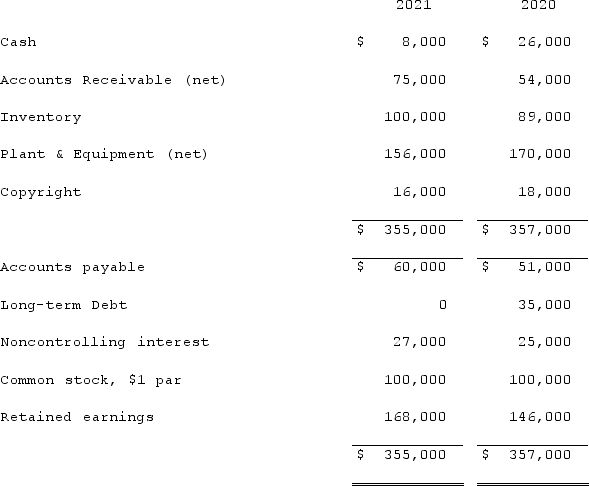

Anderson, Inc. has owned 70% of its subsidiary, Arthur Corp., for several years. The consolidated balance sheets of Anderson, Inc. and Arthur Corp. are presented below:  Additional information for 2021:The combination occurred using the equity method. Consolidated net income was $50,000. The noncontrolling interest share of consolidated net income of Arthur was $3,200.Arthur paid $4,000 in dividends.There were no purchases or disposals of plant & equipment or copyright this year.Net cash flow from financing activities was:

Additional information for 2021:The combination occurred using the equity method. Consolidated net income was $50,000. The noncontrolling interest share of consolidated net income of Arthur was $3,200.Arthur paid $4,000 in dividends.There were no purchases or disposals of plant & equipment or copyright this year.Net cash flow from financing activities was:

Definitions:

Fiduciary Duty

A duty to act in the best interests of another; such duty may arise between directors and officers and the corporation they serve, between business associates including senior employees and their employer, between agents and their principals, and between partners, also called utmost good faith.

Passing-Off

The tort of misleading the public about the identity of a business or product.

Employment Contract

A formal agreement specifying the terms and conditions of the relationship between an employer and an employee.

Trademark

A symbol, word, or phrase legally registered or established by use as representing a company or product.

Q11: When a company applies the initial value

Q11: Which of the following statements is true

Q12: This female auteur-the daughter of Hollywood royalty-began

Q30: Under the current rate method, which accounts

Q41: Prepare all journal entries in U.S. dollars

Q44: Pell Company acquires 80% of Demers Company

Q60: How does a foreign currency forward contract

Q74: Yules Co. acquired Noel Co. and applied

Q112: Strickland Company sells inventory to its parent,

Q117: When Valley Co. acquired 80% of the