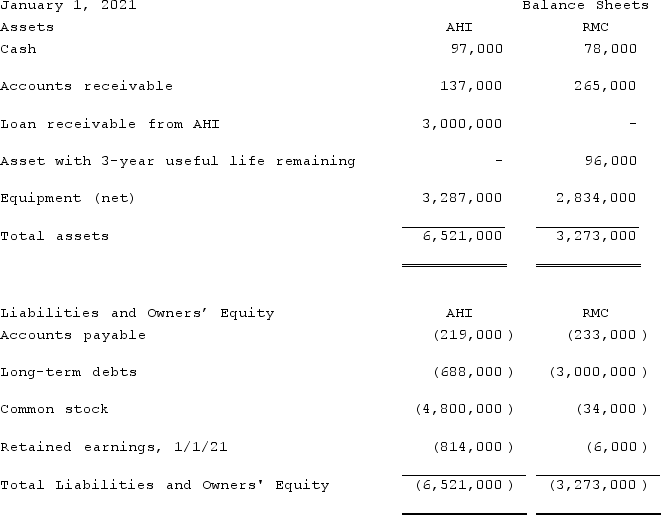

On January 1, 2021, A. Hamilton, Inc. ("AHI") provides a loan for $3,000,000 to Reynolds Manufacturing Corp. ("RMC") . The terms of the loan require payment of the loan no later than January 1, 2026. RMC was in terrible financial condition and would cease operations absent securing a loan. Prior to requesting a loan from AHI, RMC exhausted all other possible avenues for funding. The terms of the loan agreement include provisions that require RMC to provide AHI with the following from January 1, 2021 through January 1, 2026: (i) 6% annual interest on the principal amount of the loan, which reflects a market rate of interest; (ii) 100% participation rights to RMC's profits less $17,000 in a guaranteed annual dividend to RMC's common shareholders; and (iii) complete decision-making authority over RMC's operations and financing decisions.At the end of the term of the loan, AHI is given the right to acquire RMC or, in its discretion, extend the term of the original loan an additional 5 years. At the date the loan was extended to RMC, RMC's common stock had an estimated fair value of $136,000 and a book value of $40,000. The $96,000 difference was attributed to an asset with a 3-year useful life remaining ("Asset") . At January 1, 2021, the balance sheets for AHI and RMC are as follows:  With respect to the acquisition-date consolidation worksheet, which of the following is accurate?

With respect to the acquisition-date consolidation worksheet, which of the following is accurate?

Definitions:

Decision-making Power

The authority to make choices and decisions, typically within an organizational or managerial context, influencing the course of a business or project.

Control

The process of regulating and guiding operations and processes to ensure they meet objectives and perform efficiently and effectively.

Freedom

A state wherein individuals or entities are allowed to act, speak, or think without hindrance or restraint.

FTC

Federal Trade Commission; a United States government agency tasked with protecting consumers and ensuring a strong competitive market by preventing anticompetitive, deceptive, and unfair business practices.

Q7: Wilkins Inc. acquired 100% of the voting

Q21: Name Tim Burton's directorial debut, a 1985

Q35: On January 1, 2020, Hemingway Co. acquired

Q43: Name the auteur who reinvented the Hollywood

Q59: Charleston Inc. acquired 75% of Savannah Manufacturing

Q68: Pell Company acquires 80% of Demers Company

Q77: A company had common stock with a

Q105: Clark Corp. owned 75% of the voting

Q117: A parent acquires 70% of a subsidiary's

Q126: On January 1, 2021, Daniel Corp. acquired