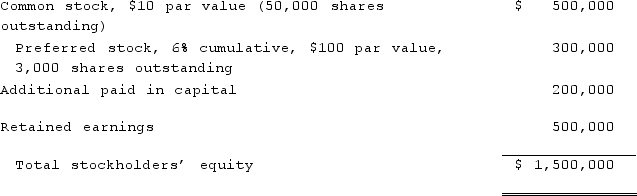

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  With respect to Nichols' investment in Smith, determine the amount to be recorded and identify which account should be adjusted to reflect such amount.

With respect to Nichols' investment in Smith, determine the amount to be recorded and identify which account should be adjusted to reflect such amount.

Definitions:

Behavioral Economics

A field of economic research that studies the effects of psychological, cognitive, emotional, cultural, and social factors on the economic decisions of individuals and institutions.

Policymakers

Individuals or groups responsible for making decisions and laws that govern a society, often within governmental institutions.

Neuroscience

The scientific study of the nervous system, including its structure, functions, and abnormalities.

Behavioral Economists

Behavioral economists study how psychological, emotional, and cultural factors affect economic decisions of individuals and institutions.

Q16: This release strategy best matches the needs

Q18: Name the American auteur who attended New

Q22: How are direct and indirect costs accounted

Q24: Carnes Co. decided to use the partial

Q48: Which of the following best describe Coppola's

Q76: A variable interest entity can take all

Q76: Boerkian Co. started 2021 with two assets:

Q81: Anderson Company, a 90% owned subsidiary of

Q93: A U.S. company's foreign subsidiary had the

Q104: The financial statements for Campbell, Inc., and