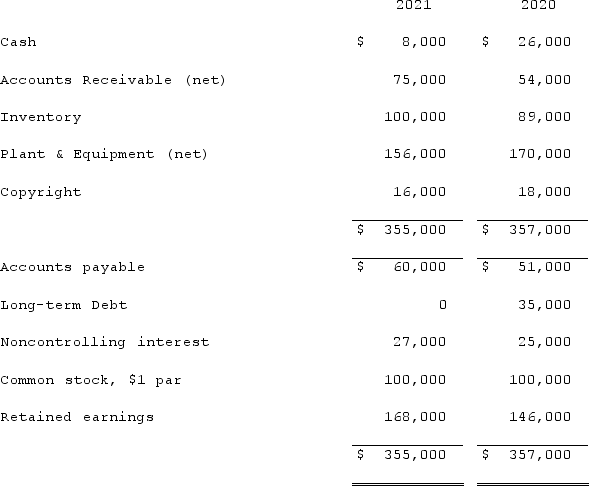

Anderson, Inc. has owned 70% of its subsidiary, Arthur Corp., for several years. The consolidated balance sheets of Anderson, Inc. and Arthur Corp. are presented below:  Additional information for 2021:The combination occurred using the equity method. Consolidated net income was $50,000. The noncontrolling interest share of consolidated net income of Arthur was $3,200.Arthur paid $4,000 in dividends.There were no purchases or disposals of plant & equipment or copyright this year.Net cash flow from operating activities was:

Additional information for 2021:The combination occurred using the equity method. Consolidated net income was $50,000. The noncontrolling interest share of consolidated net income of Arthur was $3,200.Arthur paid $4,000 in dividends.There were no purchases or disposals of plant & equipment or copyright this year.Net cash flow from operating activities was:

Definitions:

Shift

A change in the position of a demand or supply curve, indicating a change in the quantity demanded or supplied at various prices.

Price Reductions

A decrease in the selling price of goods or services, often used to stimulate demand or clear inventory.

Current Demand

The present level of desire or need for a particular product or service in the market, which can be influenced by prices, consumer preferences, and economic conditions.

Computer Manufacturers

Companies specializing in the design, assembly, and sale of computers and computer-related products.

Q1: In a business combination where a subsidiary

Q5: Pell Company acquires 80% of Demers Company

Q7: This type of feature has all but

Q12: Knight Co. owned 80% of the common

Q37: Jell and Dell were partners with capital

Q50: Flynn acquires 100 percent of the outstanding

Q85: Skipen Corp. had the following stockholders' equity

Q103: How does the creation of a consolidated

Q105: Dayton, Inc. owns 80% of Haber Corp.

Q118: Hoyt Corporation agreed to the following terms