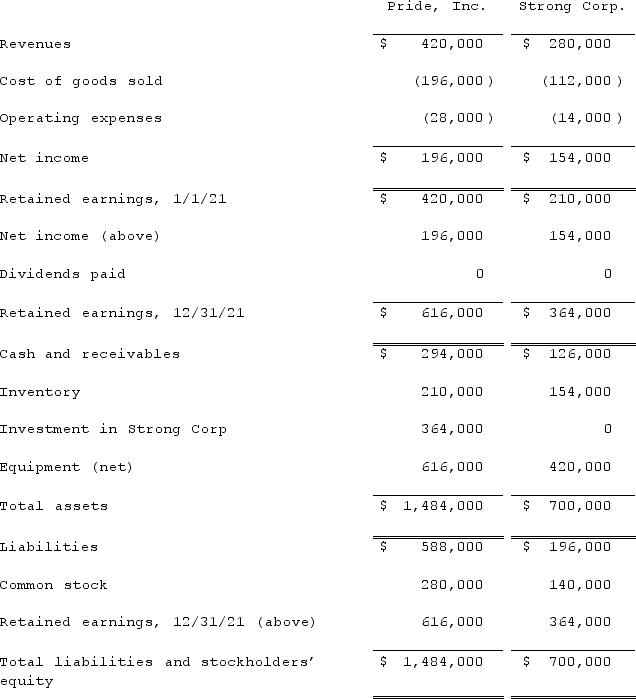

On January 1, 2021, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill, which has not been impaired.As of December 31, 2021, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated revenues at December 31, 2021?

During 2021, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of the inventory purchase price had been remitted to Pride by Strong at year-end. As of December 31, 2021, 60% of these goods remained in the company's possession.What is the total of consolidated revenues at December 31, 2021?

Definitions:

Social Tagging Search Engines

Online platforms that use user-generated tags for organizing and retrieving web content.

Bookmarking Search Engines

Web services that allow users to save, organize, and manage links to preferred web pages for easy access.

Metasearch Engines

Search tools that retrieve data from multiple search engines simultaneously to provide a comprehensive set of results.

Monitoring Algorithms

Computational techniques designed to track, analyze, and report data or performance metrics in real-time or over specified intervals.

Q2: Thomas Inc. had the following stockholders' equity

Q14: Parker Corp., a U.S. company, had the

Q16: This release strategy best matches the needs

Q41: Thomas Inc. had the following stockholders' equity

Q42: Will Co. owned 80% of the voting

Q68: Vaughn Inc. acquired all of the outstanding

Q84: Jerry, a partner in the JSK partnership,

Q94: Pell Company acquires 80% of Demers Company

Q106: Which of the following statements is true

Q106: A U.S. company buys merchandise from a