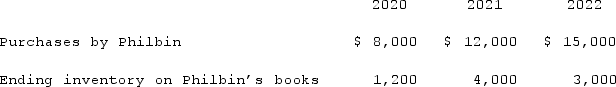

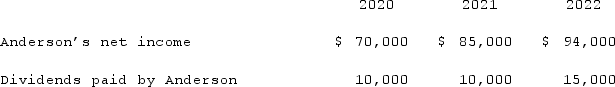

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. For consolidation purposes, what amount would be debited to cost of goods sold for the 2022 consolidation worksheet with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2022 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to cost of goods sold for the 2022 consolidation worksheet with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2022 intra-entity transfer of merchandise?

Definitions:

Snap Judgments

Quick decisions or evaluations made without thorough consideration or reflection.

Systematic Judgments

Pertains to decisions or evaluations made based on a consistent and methodical approach.

Attributions

Inferences that people draw about the causes of their own behavior, others’ behavior, and events.

Recency Judgments

The evaluations or decisions made based on the most recent information or experiences, rather than on earlier data.

Q3: Pell Company acquires 80% of Demers Company

Q10: Following are selected accounts for Green Corporation

Q14: On January 1, 2021, Musical Corp. sold

Q17: Levinson Co. established a subsidiary in Mexico

Q21: Gale Co. was formed on January 1,

Q66: Vaughn Inc. acquired all of the outstanding

Q83: McGuire Company acquired 90 percent of Hogan

Q85: Under what circumstances does a partner's balance

Q85: The financial statements for Campbell, Inc., and

Q106: Under the partial equity method, the parent