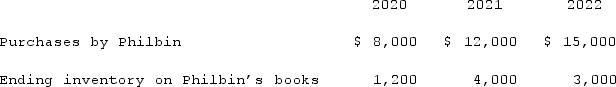

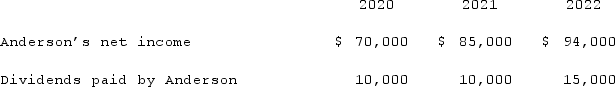

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2022 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2022 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 intra-entity transfer of merchandise?

Definitions:

Cap-and-Trade

An environmental policy tool that sets a limit (cap) on emissions and allows entities to buy and sell allowances (trade) for emitting pollutants, aiming to reduce overall pollution in a cost-effective manner.

Gaseous Fuel

Fuel in a gaseous state used for heating, cooking, or powering vehicles, such as natural gas or propane.

Carbon Monoxide Poisoning

A potentially fatal condition caused by inhaling carbon monoxide gas, which prevents the blood from carrying oxygen to cells, tissues, and organs.

Headaches and Dizziness

Common medical symptoms that can result from a variety of causes, ranging from mild conditions such as dehydration to more serious health issues.

Q5: All of the following statements regarding the

Q6: For recognized intangible assets that are considered

Q6: Flynn acquires 100 percent of the outstanding

Q8: Fargus Corporation owned 51% of the voting

Q16: The following information has been taken from

Q31: When Valley Co. acquired 80% of the

Q65: Which of the following methods is not

Q70: Esposito is an Italian subsidiary of a

Q88: What is the purpose of Consolidation Entry

Q101: McCoy has the following account balances as