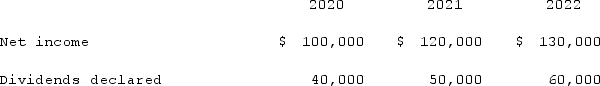

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  Compute the amortization of gain through a depreciation adjustment for 2021 for consolidation purposes.

Compute the amortization of gain through a depreciation adjustment for 2021 for consolidation purposes.

Definitions:

Thinking Evaluation

The process of analyzing and making judgments about thoughts or ideas.

Hans Selye

A pioneering endocrinologist known for his research on stress and its effects on the human body, identifying the "General Adaptation Syndrome."

Stress Theory

A framework that explains how stressors in the environment impact an individual's psychological and physical well-being.

ABC Approach

A methodical approach often used in business or personal productivity that categorizes tasks into three levels of importance: A (most important), B (important), and C (least important).

Q14: Pritchett Company recently acquired three businesses, recognizing

Q31: Under the temporal method, common stock would

Q37: The financial statements for Jode Inc. and

Q46: All of the following hedges are used

Q46: Popper Co. acquired 80% of the common

Q65: Parent Corporation acquired some of its subsidiary's

Q87: Presented below are the financial balances for

Q90: Goodman, Pinkman, and White formed a partnership

Q99: On January 1, 2021, A. Hamilton, Inc.

Q101: MacDonald, Inc. owns 80% of the outstanding