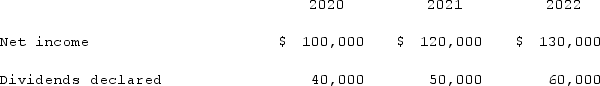

Wilson owned equipment with an estimated life of 10 years when the equipment was acquired for an original cost of $80,000. The equipment had a book value of $50,000 at January 1, 2020. On January 1, 2020, Wilson realized that the useful life of the equipment was longer than originally anticipated, at ten remaining years.On April 1, 2020 Simon Company, a 90% owned subsidiary of Wilson Company, bought the equipment from Wilson for $68,250 and for depreciation purposes used the estimated remaining life as of that date. The following data are available pertaining to Simon's income and dividends declared:  Compute the amortization of gain through a depreciation adjustment for 2022 for consolidation purposes.

Compute the amortization of gain through a depreciation adjustment for 2022 for consolidation purposes.

Definitions:

User Generated Content

Content created by users of a platform or service rather than by the platform's owners or professional producers.

Types of Social Networks

Various categories or platforms for online social interaction, distinguished by their features, purposes, and user communities.

Regular Updates

Frequent and consistent provision of the latest information or changes to all relevant parties.

Content Curation

The process of gathering, organizing, and sharing information on a particular topic or interest area.

Q31: Pepe, Incorporated acquired 60% of Devin Company

Q33: Norr and Caylor established a partnership on

Q56: Quadros Inc., a Portuguese firm was acquired

Q61: The capital account balances for Donald &

Q71: Pell Company acquires 80% of Demers Company

Q73: When a company has preferred stock in

Q87: When a parent uses the initial value

Q87: Following are selected accounts for Green Corporation

Q105: Jackson Company acquires 100% of the stock

Q112: Strickland Company sells inventory to its parent,