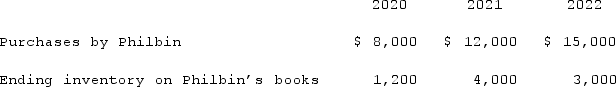

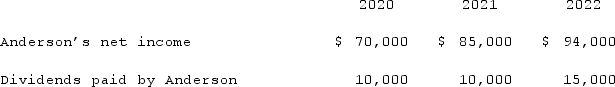

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2021.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2021.

Definitions:

Win-lose

A competitive situation or strategy in which one party’s gain is inherently the other's loss, opposed to a win-win scenario.

Fixed-amount

A specific, unchanging quantity, often referring to payments or financial transactions.

Time Warp

A hypothetical alteration of time that creates a discrepancy between it and the chronological sequence.

Win-lose

A negotiation or conflict resolution outcome where one party's gain is equivalent to another party's loss, creating a competitive and adversarial scenario.

Q9: Pell Company acquires 80% of Demers Company

Q18: Wilson owned equipment with an estimated life

Q18: How does the existence of a noncontrolling

Q33: For an acquisition when the subsidiary maintains

Q40: What would differ between a statement of

Q59: Charleston Inc. acquired 75% of Savannah Manufacturing

Q68: Vaughn Inc. acquired all of the outstanding

Q92: What is the basic objective of all

Q102: Ryan Company purchased 80% of Chase Company

Q116: On January 1, 2019, Jannison Inc. acquired