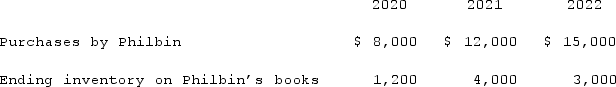

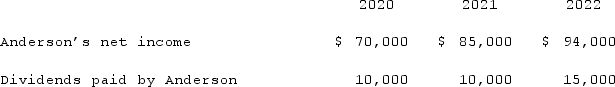

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2020 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2020 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?

Definitions:

Demand Schedule

A table that lists the quantity of a good a consumer will purchase at various prices in a market.

Supply Schedule

A table that shows the relationship between the price of a good and the quantity supplied.

Competitive Market

A market structure characterized by many sellers and buyers, free entry and exit, and products that are similar but differentiated.

Going Price

The current market rate at which a particular good, service, or commodity can be bought or sold.

Q5: Goodman, Pinkman, and White formed a partnership

Q7: Pell Company acquires 80% of Demers Company

Q25: A local partnership has two partners, Jim

Q47: What is a company's functional currency?<br>A)The currency

Q58: Where do intra-entity transfers of inventory appear

Q78: Prince Company acquires Duchess, Inc. on January

Q89: On January 1, 2020, Smeder Company, an

Q89: On January 1, 2021, Lamb and Mona

Q98: Strickland Company sells inventory to its parent,

Q110: Pepe, Incorporated acquired 60% of Devin Company