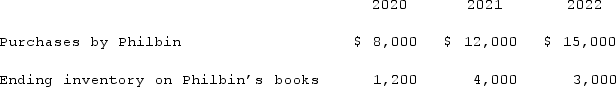

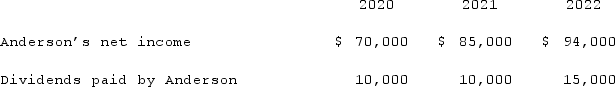

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2021 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?

For consolidation purposes, what amount would be debited to January 1 retained earnings for the 2021 consolidation worksheet entry with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2020 intra-entity transfer of merchandise?

Definitions:

Beetle

Insect belonging to the order Coleoptera, distinguished by their hard exoskeletons, wing cases (elytra), and wide variety of sizes and colors, making them one of the most diverse groups of insects.

Classification

The organizing of living organisms into categories based on shared characteristics or evolutionary history.

Evolutionary Relationships

The connections between different species or groups of organisms based on their common ancestry and evolutionary history.

Naming

The process or act of giving a name to someone or something.

Q5: Which method of translating a foreign subsidiary's

Q21: Kearns Inc. owned all of Burke Corp.

Q29: Under the temporal method, which accounts are

Q32: On January 1, 2020, Barber Corp. paid

Q43: How do intra-entity transfers of inventory affect

Q56: Following are selected accounts for Green Corporation

Q66: The ABCD Partnership has the following balance

Q78: A foreign subsidiary of a U.S. corporation

Q110: Kaye Company acquired 100% of Fiore Company

Q111: The accounting problems encountered in consolidated intra-entity