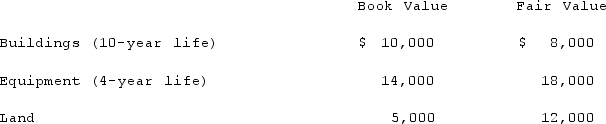

McGuire Company acquired 90 percent of Hogan Company on January 1, 2019, for $234,000 cash. This amount is reflective of Hogan's total acquisition-date fair value. Hogan's stockholders' equity consisted of common stock of $160,000 and retained earnings of $80,000. An analysis of Hogan's net assets revealed the following:  Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.In consolidation at December 31, 2019, what adjustment is necessary for Hogan's Buildings account?

Any excess consideration transferred over fair value is attributable to an unamortized patent with a useful life of 5 years.In consolidation at December 31, 2019, what adjustment is necessary for Hogan's Buildings account?

Definitions:

Creatively

In a manner that involves the use of imagination or original ideas to create something or solve problems.

Flexible Thinking

The ability to adapt thoughts and behaviors in response to changing circumstances or new information.

Brainstorming

A group discussion technique aimed at generating a wide range of ideas or solutions to a problem, without immediate criticism or evaluation.

Acculturation

The process by which individuals or groups adopt the culture of another group, often through direct contact and interaction.

Q10: On May 1, 2021, Mosby Company received

Q12: Knight Co. owned 80% of the common

Q13: McCoy has the following account balances as

Q18: Boerkian Co. started 2021 with two assets:

Q30: An intra-entity transfer of a depreciable asset

Q50: Esposito is an Italian subsidiary of a

Q57: Jackson Company acquires 100% of the stock

Q78: On January 1, 2019, Palk Corp. and

Q98: Strickland Company sells inventory to its parent,

Q116: Fesler Inc. acquired all of the outstanding