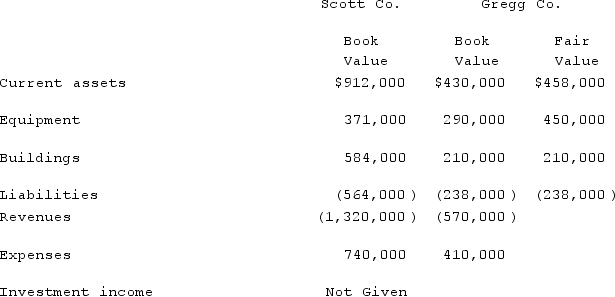

Scott Co. acquired 70% of Gregg Co. for $525,000 on December 31, 2019 when Gregg's book value was $580,000. The Gregg stock was not actively traded. On the date of acquisition, Gregg had equipment (with a ten-year life) that was undervalued in the financial records by $170,000. One year later, the two companies provided the selected amounts shown below. Additionally, no dividends have been paid.  What amount of consolidated net income for 2020 is attributable to Scott's controlling interest?

What amount of consolidated net income for 2020 is attributable to Scott's controlling interest?

Definitions:

Hypothetical Questions

Questions based on imagined scenarios or conditions, used to explore reactions or decisions in speculative situations.

Erik Erikson

A developmental psychologist known for his theory on the psychosocial development of human beings across eight stages from infancy to adulthood.

Newborn Infant

A baby in its first few hours or days of life, particularly from birth to one month of age.

Identity Crisis

A period of uncertainty and confusion in which a person's sense of identity becomes insecure, typically due to a change in their expected life trajectory.

Q20: Assume the partnership of Dean, Hardin, and

Q22: Why are the terms of the Articles

Q27: A U.S. company sells merchandise to a

Q31: The financial statements for Campbell, Inc., and

Q42: On December 1, 2021, King Co. sold

Q63: Potter Corp. (a U.S. company in Colorado)had

Q72: A net liability balance sheet exposure exists

Q81: When is a goodwill impairment loss recognized?<br>A)Only

Q97: Which of the following results in a

Q107: The financial statement amounts for the Atwood