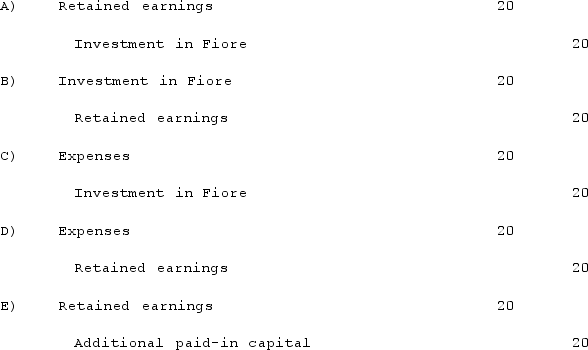

Kaye Company acquired 100% of Fiore Company on January 1, 2021. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2021 and paid dividends of $100.Assume the partial equity method is used. In the year subsequent to acquisition, what additional worksheet entry must be made for consolidation purposes, but is not required for the equity method?

Definitions:

Compensation-Level Strategy

A plan that outlines the principles and standards for setting salaries, wages, and other benefits to attract and retain talent.

Utility Analysis

A technique used in HR to assess the financial impact of different human resource practices, such as training and selection, on organizational performance.

"What If" Scenario

A hypothetical situation used for planning, problem-solving, or strategic thinking, exploring outcomes of different decisions.

Employment Standards Legislation

Laws and regulations established to protect the rights of workers, setting minimum standards for pay, work hours, and conditions.

Q16: The Keller, Long, and Mason partnership had

Q42: On December 1, 2021, King Co. sold

Q42: What information is required in the introductory

Q44: What are the two proprietary fund types?

Q66: White, Sands, and Luke has the following

Q73: When a company has preferred stock in

Q75: Woolsey Corporation, a U.S. company, expects to

Q120: Harrison, Inc. acquires 100% of the voting

Q121: On January 1, 2020, Mehan, Incorporated purchased

Q122: On January 1, 2020, Mehan, Incorporated purchased